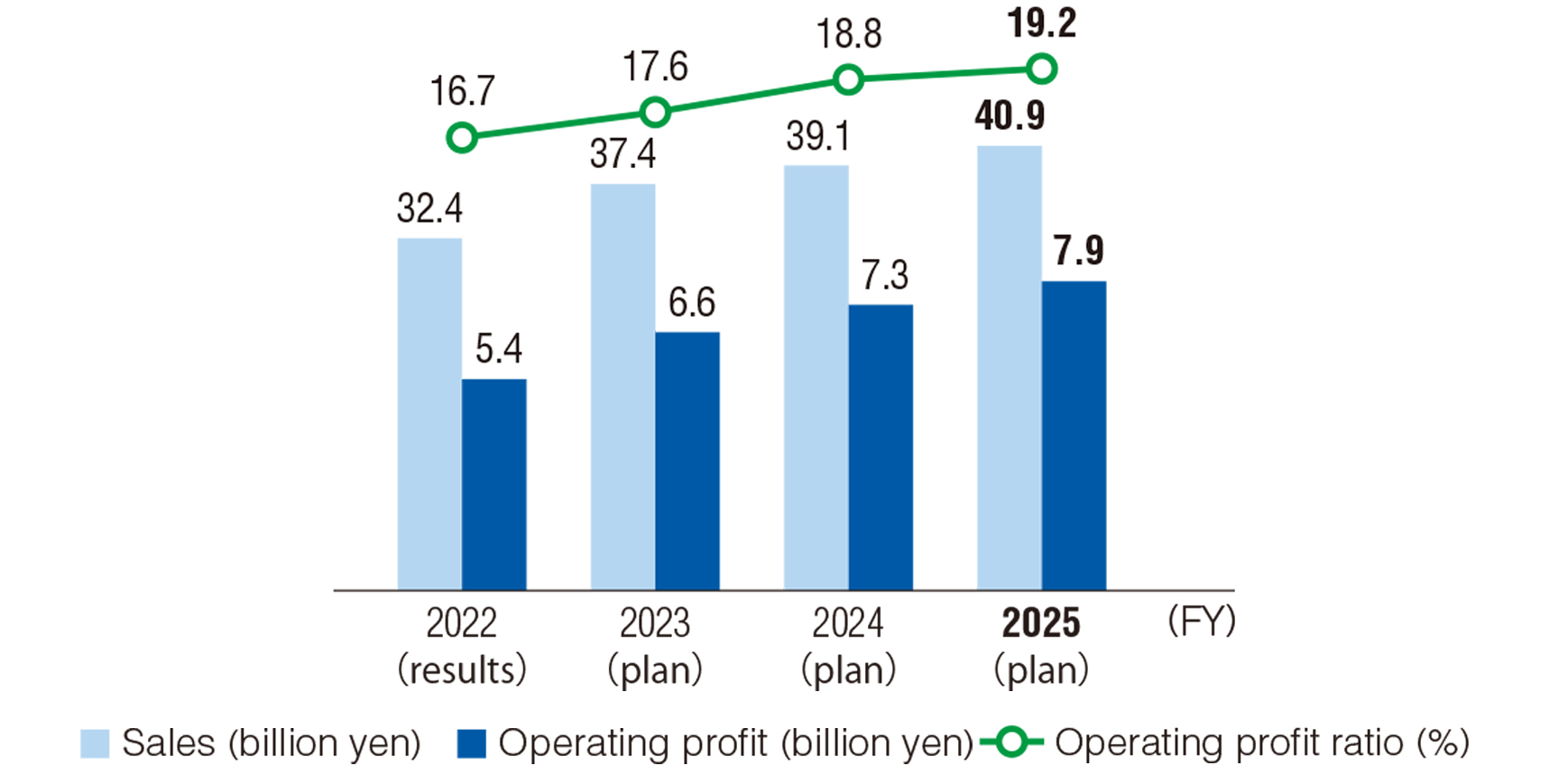

Positioning chemicals for special fibers, chemicals for special electronic parts, lubricant additives, permanent antistatic agents, and medical and pharmaceutical products, which contribute to carbon neutrality and the improvement of QOL, as five focus product groups, we plan to make capital investment of nine billion yen from FY2021 to FY2025, which includes the period of the Medium-Term Management Plan. We expect an incremental operating profit of 2.5 billion yen from this capital investment, and aim to achieve an operating profit of 7.9 billion yen by FY2025 from the five focus product groups. We will also consider additional investments in order to further expand our business.

Results and targets of sales / operating profit / operating profit ratio for five focus product groups

(Note) Research and development expenses (approx. two billion yen per year) related to new businesses are recorded as company-wide expenses and are not included in the above operating profit.

Accelerate capital investment in high-value-added products

(Note) (Start year / Investment amount [billion yen])

Chemicals for special fibers

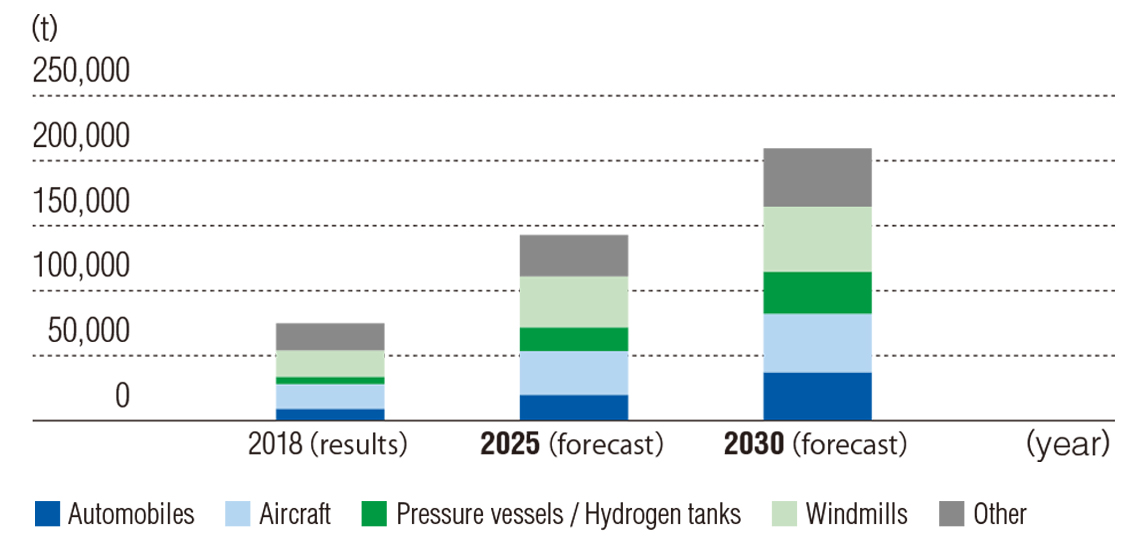

These products contribute to carbon neutrality. Our chemicals for special fibers are mainly used for carbon fibers. Blades of windmills, which are one of the main uses of carbon fibers (windmills, automobiles, aircraft, and pressure vessels), are seeing a rapid increase in demand due to the spread of renewable energy. Demand for carbon fibers is expected to expand as wind power generation increases, and blades become larger. In addition, the development of applications in new fields is progressing. In order to respond to growing demand for carbon fibers, we have decided to increase the production capacity for sizing agents for carbon fibers. In addition to the existing facilities at the Nagoya and Kyoto Factories, we plan to establish a new production facility at the Kashima Factory. The facility is scheduled to start operation in May 2024, increasing production capacity by approximately 50%. We will seek to secure a stable supply of sizing agents for carbon fibers in order to respond to the growing global demand. We would also like to play a major role not only in the utilization of renewable energy and the development of its industry, but also in addressing climate change. We will continue to consider further capacity expansion in order to meet the growing demand for carbon fibers.

Global market forecast for carbon fiber reinforced plastics by application

(Source) Created based on “Global carbon fiber reinforced plastics (CFRP/CFRTP) materials and technology report: Market size, applications, share, trends 2020” by FUJI KEIZAI CO., LTD.

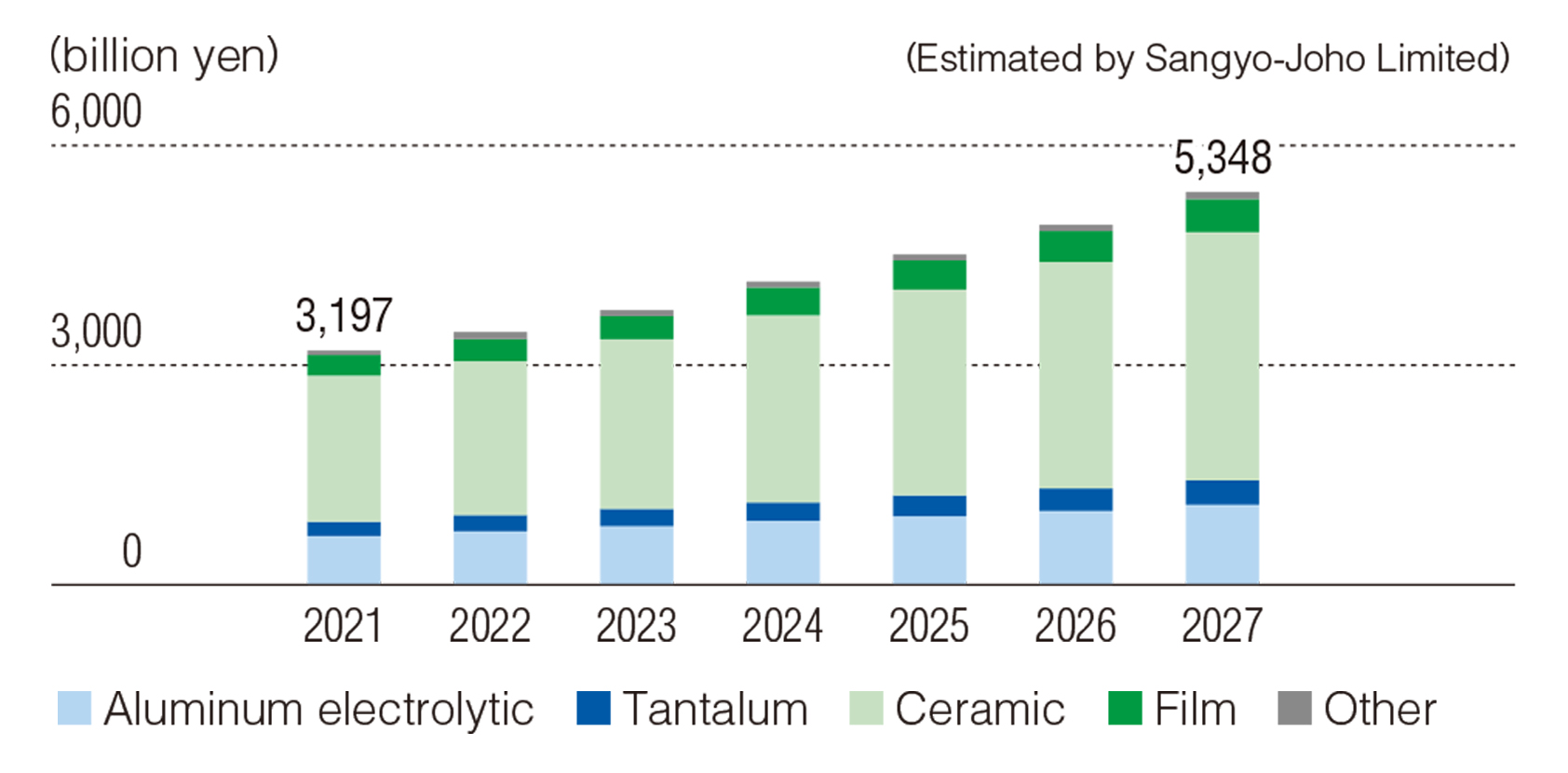

Chemicals for special electronic parts

These products contribute to carbon neutrality. Our chemicals for special electronic parts include electrolytes for aluminum electrolytic capacitors, which are mainly used in electronic circuits. Electrolytes for aluminum electrolytic capacitors are used in a wide range of applications, from general electronic devices to important electronic parts that support social infrastructure. Our electrolytes for aluminum electrolytic capacitors exhibit high electrical conductivity over a wide temperature range and are excellent in long-term stability at high temperatures. As industry-standard long-run products, they are used in capacitors that require higher reliability, such as automobile control units. Currently in the automobile industry, an increasing number of automobile electrical parts, such as driving support system circuits, are used due to the electrification of vehicles such as electric vehicles (EVs). In order to ensure a stable supply that meets this growing demand, we have decided to increase our production capacity. The current production capacity will be increased by 60% by March 2025.

Forecast for global production of capacitors

(Source) Created based on “2022 Capacitor Market” by Sangyo-Joho Limited.

Lubricant additives

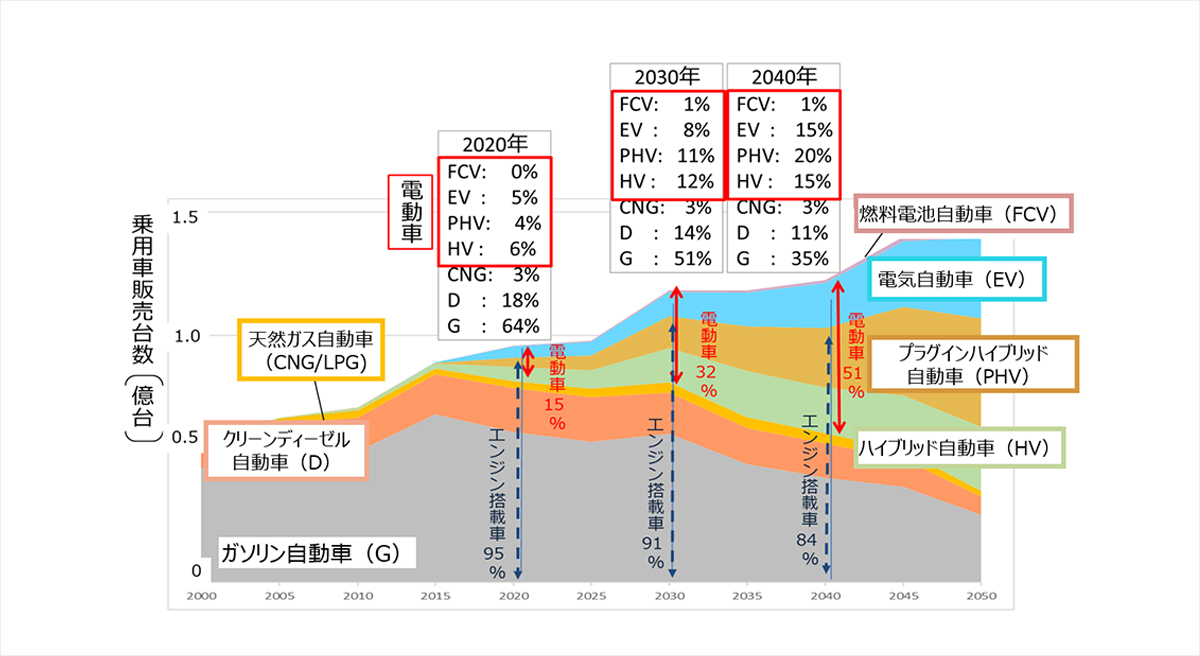

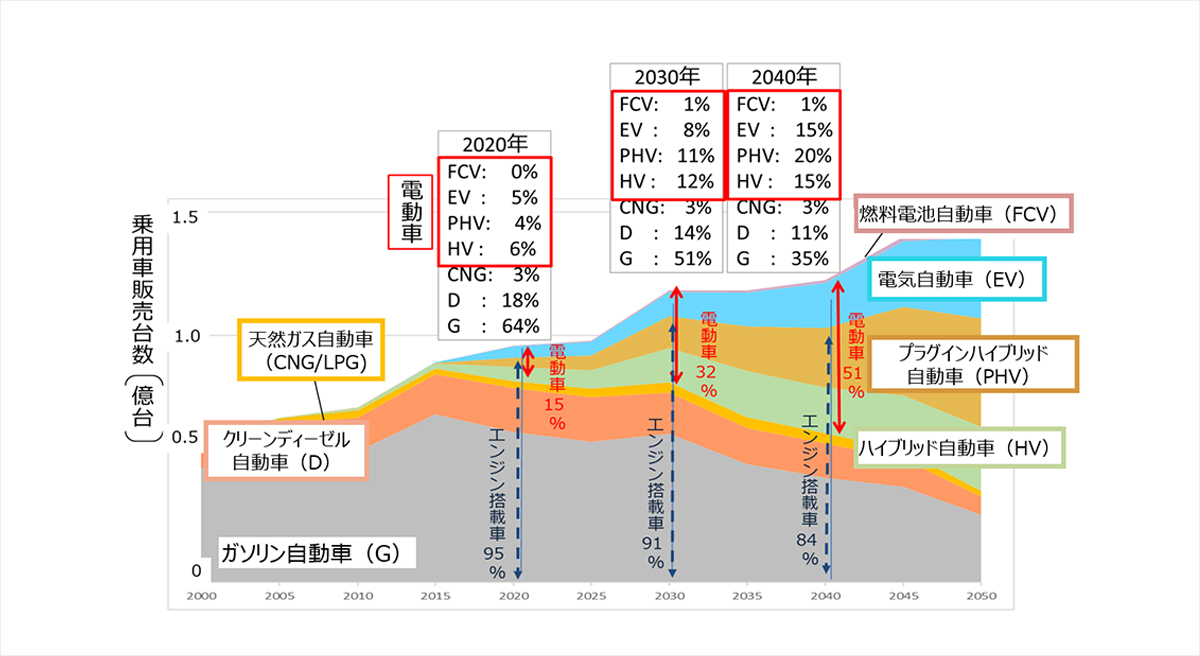

These products contribute to carbon neutrality. In the automobile industry, in order to reduce CO2 emissions, there is a growing need for fuel-efficient gasoline vehicles, along with the trend toward electrification. Since our lubricant additives are highly effective in improving fuel efficiency, they are used in the engine oils of gasoline vehicles, hybrid vehicles (HVs), and plugin hybrid vehicles (PHVs). It is assumed that their replacement demand at the time of after-sales maintenance will increase. To meet the growing global demand for these products, we have established a production site in South Korea, following those in Japan and China, which has already started operation. We are also working on the development of lubricant additives optimized for EVs in order to contribute to improving the fuel efficiency of all vehicles.

Forecast for sales of gasoline vehicles, hybrid vehicles, and plug-in hybrid vehicles

*Horizontally scrollable

(Source) Ministry of Economy, Trade and Industry, “Technology Diffusion Scenario Presented by IEA (a case where an average temperature rise of 2°C is achieved)” (2021) (in Japanese)

https://www.enecho.meti.go.jp/about/special/johoteikyo/gosei_nenryo.html

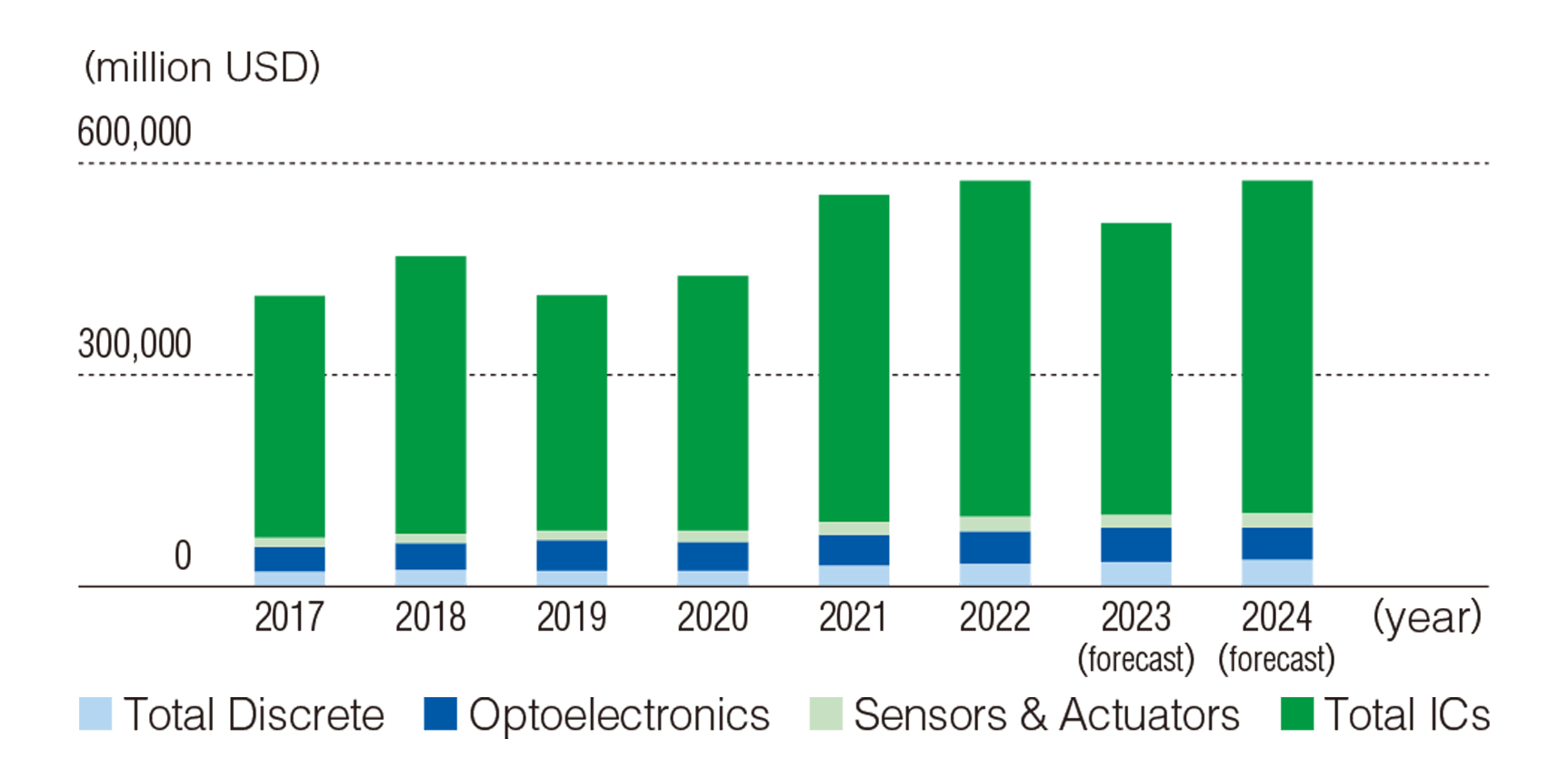

Permanent antistatic agents

These products contribute to the improvement of QOL. Permanent antistatic agents are used in a wide range of applications to prevent various problems caused by static electricity (destruction of electronic circuits, malfunction of electrical appliances, adhesion of dust) and accidents (fires, explosions). In recent years, in addition to an increase in demand centered on semiconductor carrier trays and the packaging of electronic devices and precision parts, explosion-proof and other applications are expanding. In order to meet future demand expansion, we have launched a new production site at the Rayong factory of Sanyo Kasei (Thailand) Ltd., which has been in operation since July 2022. Since permanent antistatic agents are our unique, high-functionality products, we will strive to open up new markets while taking into account the possibility of further expanding the production facility depending on our future demand. We will also promote the development of new materials.

Semiconductor market forecast by product

(Source) Created based on “WSTS Semiconductor Market Forecast Spring 2023” by WSTS (World Semiconductor Trade Statistics) Japan Council

Medical and pharmaceutical products

These products contribute to the improvement of QOL and mainly include polyethylene glycol for pharmaceuticals and non-absorbable topical hemostatic materials for the central circulatory system.

Polyethylene glycol for pharmaceuticals is used as a pharmaceutical additive in a base material for ointment and tablet coating agents, and is used as an active pharmaceutical ingredient for colon cleaning agent. It is also used in various applications such as tissue regeneration and cell culture. To meet demand expansion due to increased sales, which is caused by the development of generic drugs, we plan to expand the facilities at the Nagoya Factory. These facilities are scheduled to start operation in May 2024, with the production capacity expected to increase by approximately 20%.

Non-absorbable topical hemostatic materials for the central circulatory system are surgical hemostatic agents made of polyurethane materials that react with water to form a flexible film. Since their launch in 2014, they have been used in many cardiovascular surgeries in Japan as hemostatic materials used in the anastomosis of the thoracic aorta and the branch of the aortic arch for artificial blood vessel replacement. In March 2020, the scope of their application was expanded to include the anastomosis of whole blood vessels except cerebral vessels. In July 2019, we obtained the CE marking for products for overseas shipping, and started their sales in the European market. Using this as a foothold, we are accelerating our overseas expansion, including entering the Hong Kong market in July 2021 and the Taiwanese market in December 2021. We will ensure its stable supply to satisfy growing demand by increasing our production capacity to approximately five times (scheduled to start operation in February 2024).