We would like to thank you for your continued support. We are pleased to report that our fiscal year 2024 ended on March 31, 2025. It would be most grateful if you, could provide continued support and cooperation.

Akinori Higuchi

Representative Director, President, and CEO

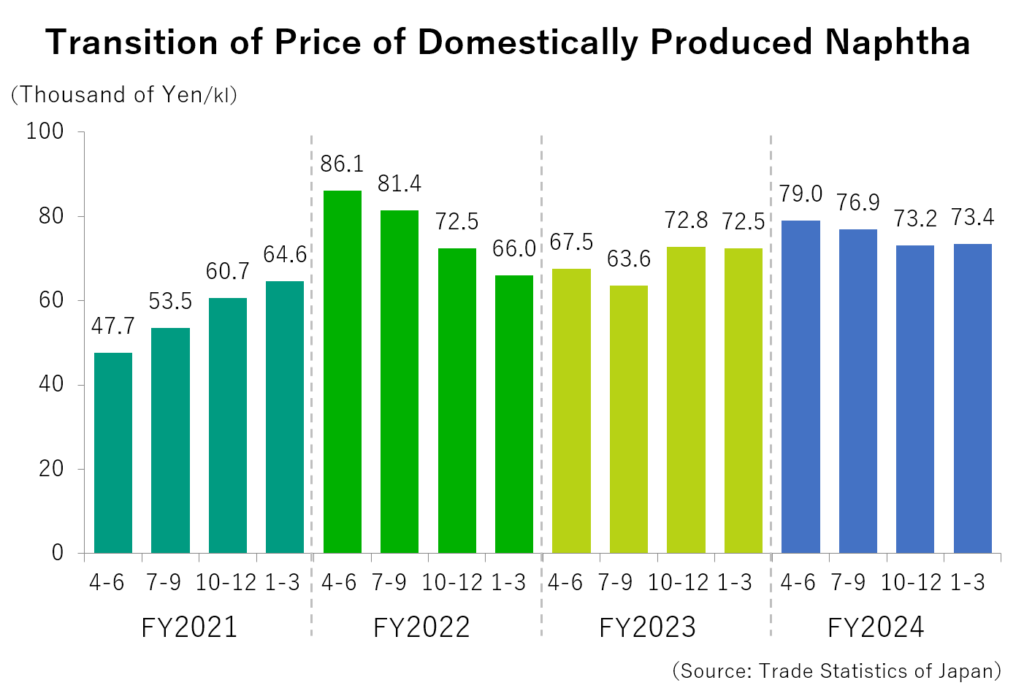

Sanyo Chemical Group business environment in FY2024

During the fiscal year ended March 31, 2025, Japanese economy showed a gradual recovery despite a decline in consumer sentiment due to high prices against a backdrop of an improvement in the employment and income environment. After the yen depreciated, there were moments when it sharply rebounded due to interest rate cuts in the U.S. and Europe and the Bank of Japan’s interest rate hike. However, due to factors such as the limited narrowing of interest rate differentials, the yen fluctuated wildly throughout the year, resulting in a slight appreciation. Crude oil prices also remained high due to geopolitical risks surrounding the Middle East region. In the global economy, while the U.S. economy has remained resilient and the European economy showed a recovery trend, and although China saw a temporary recovery due to policy measures, its autonomous economic recovery has lagged due to factors such as deteriorating real estate market conditions. In addition, the recent trend in U.S. tariff policies, the prolonged situation between Russia and Ukraine, and the ongoing instability in the Middle East have created an extremely uncertain outlook.

In the chemical industry, the business environment is undergoing irreversible changes, such as intensifying price competition due to the influx of Chinese products into the Japanese and Asian markets as a result of sluggish Chinese domestic demand and oversupply.

Under such an environment, the Company decided in the previous fiscal year to withdraw from the superabsorbent polymer business and cease production in China as part of the structural reform under the “New Medium-Term Management Plan 2025.” In the fiscal year ended March 31, 2025, in accordance with this decision, we completed the transfer of our equity interest in San-Dia Polymers (Nantong) Co., Ltd. and withdrew completely from the superabsorbent polymer business. We are steadily progressing with our business portfolio reform aimed at shifting to high-value-added businesses. In addition, with regard to cost reduction and working capital compression across the entire supply chain, which is part of our “Monozukuri Transformation,” we are progressing at a pace that exceeds our targets, contributing to the recovery of earnings in our core businesses.

Results for FY 2024

Net sales for the fiscal year ended March 31, 2025 decreased 10.8% year on year to ¥142,258 million due to the withdrawal from the superabsorbent polymer business. In terms of profit, operating profit was ¥8,439 million (an increase of 72.7% year on year) and ordinary profit was ¥9,670 million (an increase of 18.1% year on year) mainly due to strong performance in the advanced semiconductor field, expanded sales of high-value-added products, and improved profitability through structural reforms. Profit attributable to owners of parent was ¥4,151 million

(compared with a loss of ¥8,501 million year on year, which included ¥12,059 million in business restructuring expenses), due to the recording of a loss on valuation of investments in capital and business restructuring expenses.

The loss related to the aforementioned business restructuring was estimated to be a total of ¥20.0 billion over multiple fiscal years from the previous fiscal year, but approximately ¥12.0 billion was recorded in the previous fiscal year, and approximately ¥1.2 billion, including impairment losses on San-Dia Polymers (Nantong) Co., Ltd., was recorded in the fiscal year under review.

About the New Medium-Term Management Plan 2025

As we enter the final year of our New Medium-Term Management Plan 2025, we recognize that the key challenges we face are as follows: (1) strengthening our ability to generate higher profits through initiatives such as the “Reformation of Existing Business,” “Growth from Core Business,” and “New Growth Path”; and (2) accelerating the enhancement of our business portfolio to flexibly respond to changes in the external environment. We will focus on the following initiatives, particularly by allocating resources to growth businesses that will become our main sources of revenue in the future.

For the “Reformation of Existing Business”, We aim to increase profits by developing differentiated products that meet market needs. In addition to the ongoing “Monozukuri Transformation” initiative, which seeks to improve efficiency across the entire supply chain, we will also promote the “Production Facility Restructuring” initiative, which involves the consolidation and integration of production facilities, to build an optimal production system for the entire Group. Furthermore, we will explore and pursue alliances with other companies to enhance the profitability and competitiveness of our core businesses.

For the “Growth from Core Business”, We will focus our resources on priority projects and initiatives to expand our lineup of high value-added products category. In particular, we will promote product development and marketing activities in the semiconductor field, and introduce small-scale reactors to accelerate the development of small-scale, high value-added projects.

For the “New Growth Path”, We will promote the commercialization of the artificial protein “Silk-Elastin” in the United States. In addition, with the aim of contributing to carbon neutrality and improving quality of life (QOL), we will focus on initiatives to commercialize new businesses in fields such as food and healthcare (e.g., smell sensors, peptide for agriculture, land-based aquaculture, battery materials).

In addition, we will implement plans to construct a new research building to strengthen our R&D capabilities, promote global marketing with a focus on the U.S. and Indian markets, and build an efficient and sustainable logistics system through partnerships with logistics companies. We will also strengthen initiatives to support a sustainable business foundation, including the formulation of a roadmap for CO₂ emission reductions toward carbon neutrality by 2050, focusing on key material issues.

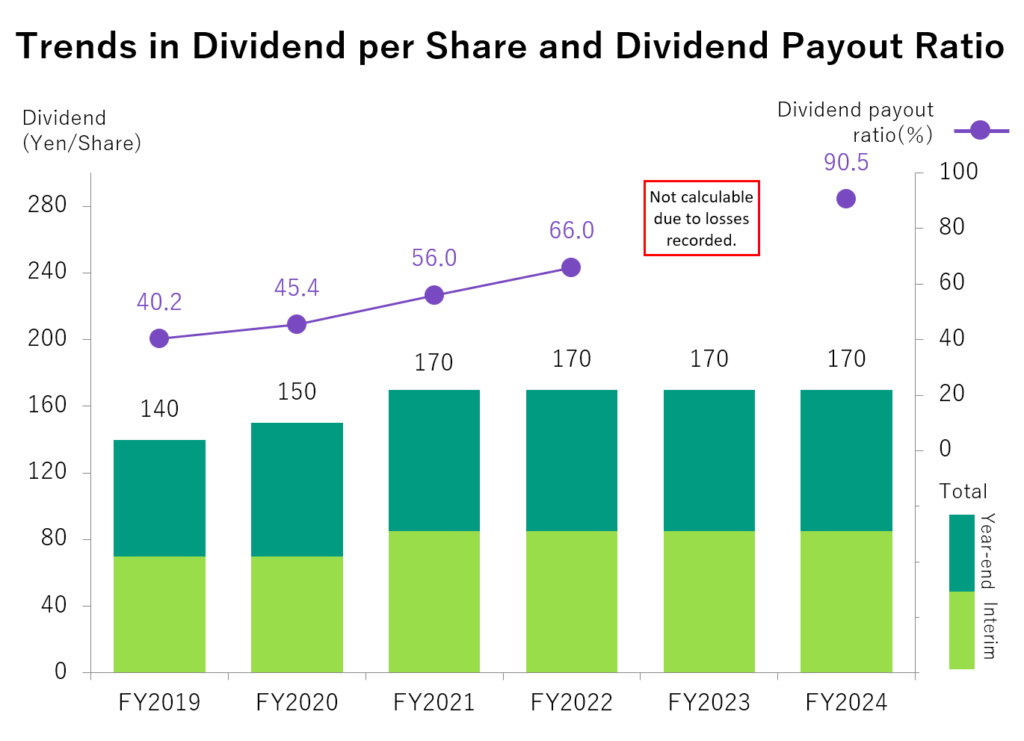

Return of profits

The year-end dividend for FY2024 was 85.0 yen per share (annual dividend of 170.0 yen per share). For the next fiscal year, we plan to pay an interim dividend of 85.0 yen per share and a year-end dividend of 85.0 yen per share (equating to an annual dividend of 170.0 yen per share). The Company considers it an important management issue to enhance the return of profits to shareholders while improving the earning capacity of the Group by reinforcing the corporate infrastructure into the future. We aim to increase the level of dividends over the medium to long term, with a target consolidated dividend payout ratio of 30% or more.

In conclusion, please give a message.

We are committed to improving our profitability, achieving sustainable growth in the future, and achieving our “vision” through these efforts, while at the same time providing enhanced returns to all of our stakeholders. We look forward to your continued support and cooperation.